The Importance of Customer Experience During Mergers

Mergers and acquisitions activity in 2006 reached record levels, and it’s likely that the pace will increase in 2007.

In the midst of the epic deal-making, companies should look beyond immediate benefits for shareholders and executives, and pay very close attention to the impact of mergers (and other major organizational shifts) on customer experiences. Why? Because acquired customers are easily lost.

Mergers and acquisitions create transition points, moments when avoidable customer experience mistakes sour once strong relationships with loyal customers of an acquired company, and they depart permanently. This is doubly unfortunate: the right customer experience can bridge old and new for acquired customers, and provide reassuring continuity during times of substantial flux in areas such as brands and identities, corporate cultures, organizational structures, supporting enterprise architectures and systems , even customer service procedures.

Well-managed customer experiences offer two kinds of specific benefits. The first benefit is an unexpected (and thus more powerful) refutation of established wisdom from across industries that defines post-merger service expectations as bad. Consider these two examples:

From If more US airlines merge, who would benefit?:

Aviation analysts like Kevin Mitchell of the Business Travel Coalition in Radnor, Pa. … argues that a flurry of mergers right now would raise prices, overcrowd already-packed planes, and create chaos for customer service for years to come precisely because it is so difficult to merge aviation corporate cultures.”Of course, Wall Street is going to push it,” he says. “What’s good for investors, shareholders, and management may not be good for others: Lots of employees will be laid off, and customers can look forward to 20 to 30 percent price hikes and several years of customer-service [misery].”

And this from FCC clears AT&T merger:

Natalie Billingsley, a supervisor with the California Public Utilities Commission’s Division of Ratepayer Advocates, which advocates for consumer interests, said the new concessions improved the outlook for AT&T and BellSouth customers. But she said consumers would have been better off if the merger had not been approved and expressed skepticism that customer service would improve.

“You hope that service will improve, but it hasn’t been seen with prior mergers,” she said.

The second benefit is balancing the service disruptions common to post-merger integration (sometimes collision is the better word) efforts with a positive experience oriented toward the longer term. This is especially important for acquired customers, who lack examples of how the acquiring company handles customer relationships, and need surety regarding it’s intentions.

Enterprise business process, information architecture, and technology integrations (your SAP or mine…) are notably prone to conflicts that can disrupt customer experiences in dramatic and unexpected ways. Much of the disruption is easily managed in advance by communicating upcoming changes to customers. The rest is best handled by the customer experience equivalent of the detour. While the details may prove complex behind the scenes, the basic idea is very simple: tell acquired customers that things used to work one way, explain that they now work another, then show them how, and support them through the required changes.

Because the idea is so simple, organizations that fail to anticipate and respond to customer experience disruptions during integration efforts neglect the basics of building sound relationships with acquired customers. Neglecting acquired customers from the beginning is a good indicator that the new organization places low value on customer relationships in general. With bad experiences during botched transitions, customer satisfaction declines, relationships sour, and loyal customers leave.

Snapshot of a Disrupted Experience

AmericanBank recently acquired MegaBank, and integrated the two companies’ on-line banking tools. These tools served credit card customers, in addition to banking customers. But since neither MegaBank nor AmericanBank communicated information or plans about the merger (no detour…) to MegaBank credit card customers, the stream of personally addressed emails issued from mysterious sources inside AmericanBank looked exactly like a credit card fraud spam broadcast designed to snare the unwary.

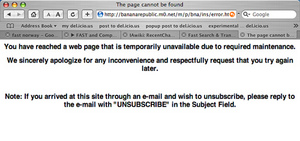

Following the email broadcasts, AmericanBank abruptly redirected traffic from the MegaBank account portal to the AmericanBank website, without notifying MegaBank customers of the switch, thereby mimicking another common tactic in fraud efforts – the decoy log-in screen intended to extract user IDs and passwords from unsuspecting visitors, who do not recognize the difference between the legitimate and fake log-in gateways.

More disruptive for MegaBank customers was AmericanBank’s decision to erase their log-in names and then create new user names in those cases where MegaBank log-ins happened to duplicate those of existing Bank of America customers, effectively displacing them. This particular change would have been troublesome with adequate communication, since user names and passwords present extensive usability and memory challenges, but again AmericanBank failed to notify MegaBank customers of the changes.

As icing on the cake, AmericanBank created new passwords for MegaBank credit card customers as well, again without notification. The combination of new log-ins and new passwords made it impossible for MegaBank credit card customers to access any of AmericanBank’s on-line account management functions.

MegaBank customers trying to use their normal on-line account management tools experienced this series of integration steps as spam broadcasts, hijacked navigation, recognition failure, displacement, and a password recovery loop leading to account lock-out. The only way to sort it out and regain access was a laborious staged phone call that revealed the regular to customer service channels couldn’t handle on-line access problems.

In the end, MegaBank customers incurred direct costs in the form of service charges to make payments by phone while locked out of the on-line system, late fees for missing payments while sorting out the account access issues, and punitive interest rate raises based on automated application of contract rules triggered by late payments. The complete reckoning includes additional indirect costs in the form of frustration, confusion, wasted time, and the effort required to find a substitute credit card servicer.

All in all, the customer experience of the AmericanBank and MegaBank integration provided clear signs of:

- misaligned business structures

- mismanaged integration

- an unbalanced short term outlook

- poor relationship management

- punishing customers for bad business decisions

From the perspective of an acquired customer, it’s easy to recognize these as symptoms of internal ill health, manifest as indifference or ill will toward customers. Which equates to strong incentive to leave in 2006, and not return in 2007.